The power of integrated digital data: a study of UK challenger banks

The power of integrated digital data: a study of UK challenger banks https://www.citizenme.com/wp-content/themes/corpus/images/empty/thumbnail.jpg 150 150 Josh Hedley-Dent Josh Hedley-Dent https://secure.gravatar.com/avatar/92b5c9b625d72910689d23e5aed19785?s=96&d=mm&r=gThe survey is a valuable source of data and insight. However, in a 21st century digital economy, consumer research requires integrated data from different parts of people’s life.

Businesses know this, with 3 in 5 businesses reporting an increase in the use of integrated data (1). CitizenMe’s platform is a solution to this challenge. It allows businesses to access multi-source integrated data to super-charge their insights.

Whilst conceptually the benefits of using new data types are obvious – the more data we have the easier it is to understand individuals – the tangible benefits of how it improves your insights are sometimes hard to fathom, especially when using completely new data types in research.

With this in mind we’ve created the first, in a series, of case studies that bring the benefits of integrated data to life.

Deep Insight from a Mobile Micro Survey

Micro surveys are popular for their quick turnaround, but the compromise is less data and insight. We believe that integrating digital behavioural and passive data to 3 questions will over-come these compromises.

The research we conducted aims to explore the impact of challenger banks. Who’s taking an early lead and which, if any, incumbent bank is most at risk of being disrupted?

We asked three questions:

- Which UK banks are you aware of (prompted mix of incumbent and challenger brands)?

- Which of these banks do you have a financial product with?

- Likelihood of using a bank without a high street retail presence

We added basic profiling data:

- Age

- Gender

- Annual Salary

- Social Economic Grouping (SEG)

So this is possible on existing market research platforms. However, using the CitizenMe platform, we provide ethical and fully transparent access to some amazing digital data. We added:

- Apps downloaded on the participants’ smartphones

- OCEAN Big 5 personality traits

- Page Likes on Facebook

Here is a snapshot of our findings with a link below to download the full report.

Changing Financial Landscape

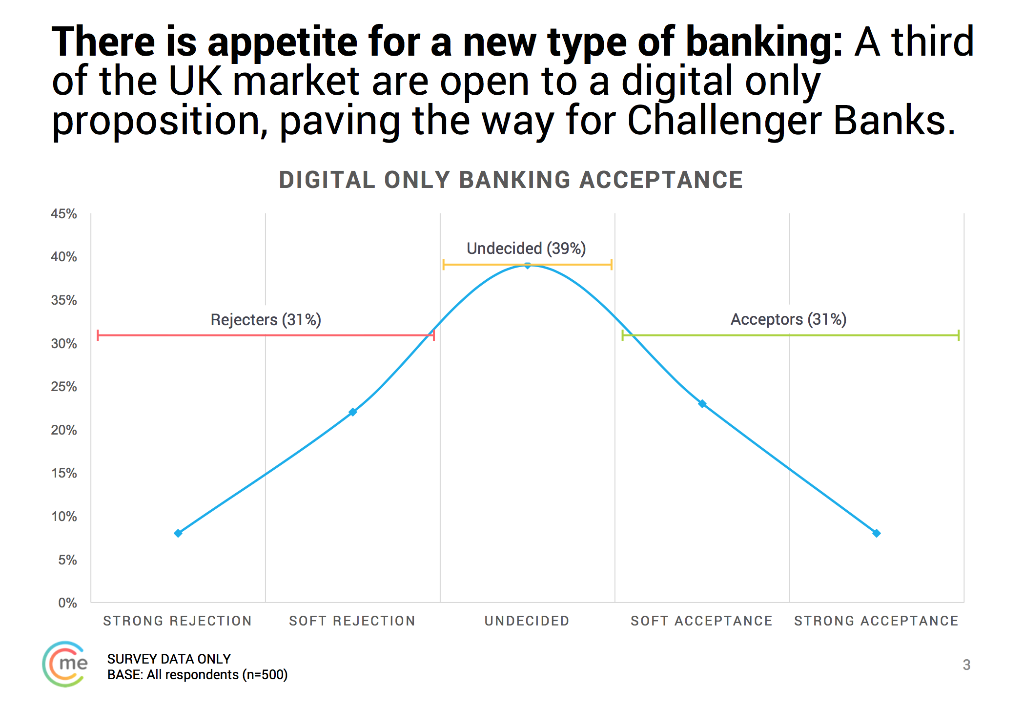

Over the past couple of years, the UK has increasingly seen a rise in the number of digital ‘challenger’ banks emerge. Banks with no high street presence, mobile app based, and trying to help you better manage your money are the common themes that unite these newcomers. But is there appetite for a new style of banking? Our research says yes, with nearly 1/3 already willing to use a financial product with no high street presence.

Paint me a picture

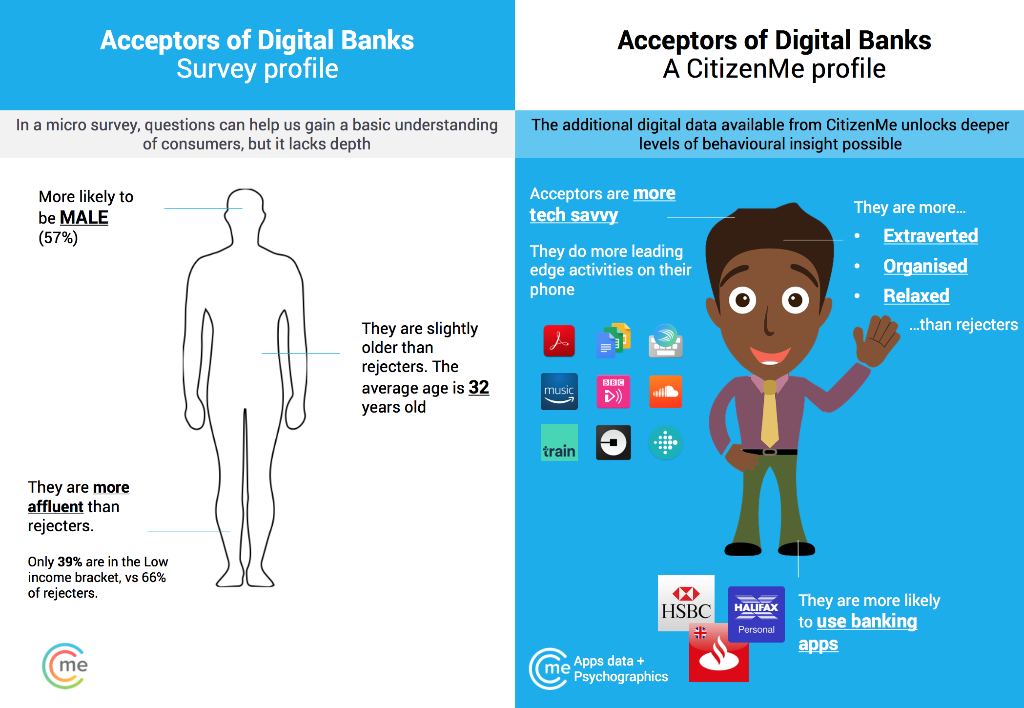

So who are the trailblazers willing to shift to this new style of banking? By integrating OCEAN Big 5 personality type, apps installed on smartphones, and Facebook Page Likes to the survey, we were able to paint an incredibly vivid image of what they look like, and one that a traditional survey could never get to:

Channels and Messaging

We were able to identify which social channels acceptors of digital only banks use. In addition we were able to provide recommendations on how best to communicate marketing messages to this group. To find out the results and how we arrived at these conclusions download the full report here.

(1) Greenbook GRIT report H2 2016

- Posted In:

- Business blog

Leave a Reply