5 ways to improve survey UX

5 ways to improve survey UX https://www.citizenme.com/wp-content/uploads/2017/07/priscilla-du-preez-216790-1-1024x682.jpg 1024 682 Josh Hedley-Dent Josh Hedley-Dent https://secure.gravatar.com/avatar/92b5c9b625d72910689d23e5aed19785?s=96&d=mm&r=gWe believe that the future of a thriving market research industry is one based on putting the participant user experience first. At CitizenMe we think about, and design, our product around this belief.

The finding in the latest GRIT report that ‘being able to trust the results of research’ was the top concern for both suppliers & buyers shouldn’t come as a surprise. What was surprising, though, was another statistic from the same question: that only 7% of research providers ranked participant experience as an important factor when designing a project. It seems a worrying disconnect has emerged between the data being used and its source; the participants. This lack of focus on user experience is being felt by participants too: according to a recent GRIT Customer Participant in Research report, only 1/4 say they are truly satisfied with their experience. If market research is to remain relevant, and be based on high quality data, more attention needs to be paid to the UX for respondents.

At CitizenMe we strongly believe that creating a great user experience is central to ensuring continued, quality data. Outlined below are 5 key areas as an industry research needs to address, and how we’re approaching it at CitizenMe.

1) Design is key

A central part to good user experience of any product or service is design, and research is no different. The way a survey & the interface is designed has an enormous impact for the respondent: according to the GRIT CPR report, 55% of participants say the design impacts their willingness to complete. The potential skews borne from omitting over half of the population are huge. What’s more, the exact impact of this remains unknown considering they will be ‘hidden’ skews, unmeasurable and unaccountable through demographic quotas or weighting.

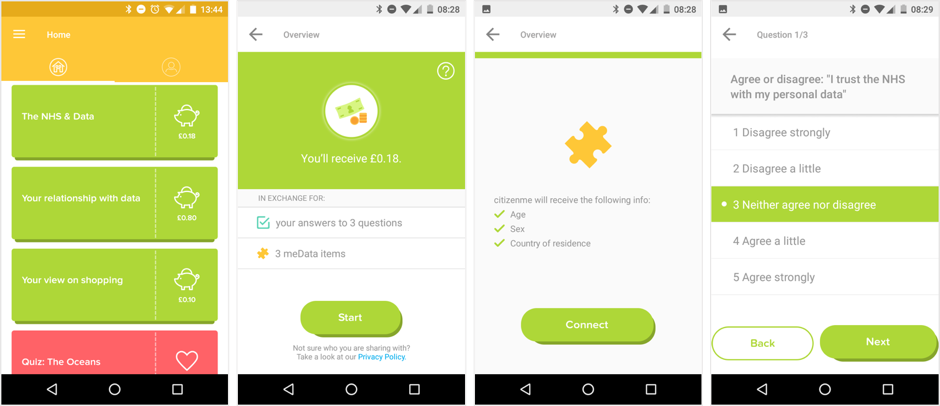

To address this issue, we’ve spent a lot of time designing & tweaking our app to make it as engaging as possible. A simple user interface allows respondents to easily navigate through the app, and select the research studies they want to participate in.

We don’t do long chessboard-like grids of questions, and we never will. We are mobile first and we believe if it doesn’t work on mobile, it doesn’t work at all. Simplicity has been at the core of our design, and so far the feedback has been pretty good:

We’ve found that when you keep it simple, improvements are easier to test and easier to implement. Our aim is to make answering a question as easy, quick and enjoyable as possible. We’re currently experiencing 60-80% response rates and we’re working on ways to measure participant attention levels. The product and design team are testing new interaction screens and engagement techniques. We aim to be the world leader in how people engage with their data and that goes beyond just the experience of answering questions.

2) Shorten your survey

How long is a piece of string? Well in research, it’s under 10 minutes: over 1/2 research participants say this should be the maximum length of any survey. Survey length not only impacts participants’ willingness to complete, but also the quality of data from those who do bother to finish: over 1/3 say time commitment affects their honesty & attention to detail for quantitative research. In a digital world where we are used to instant gratification and being engaged for only short periods of time, people no longer have the patience to spend 25 minutes completing a survey.

Whilst participants want less, businesses demand more, so how do we tackle the problem? For one, taking a ‘lean’ approach to research is a way we champion with our clients: break large business questions down into smaller chunks of research, and work iteratively – allowing for improvements and adjustments to be made throughout the process, as opposed to once at the end. Breaking research down into smaller chunks not only makes research far more engaging for participants, but also gives businesses the chance to create ongoing relationships with actual (and potential) customers.

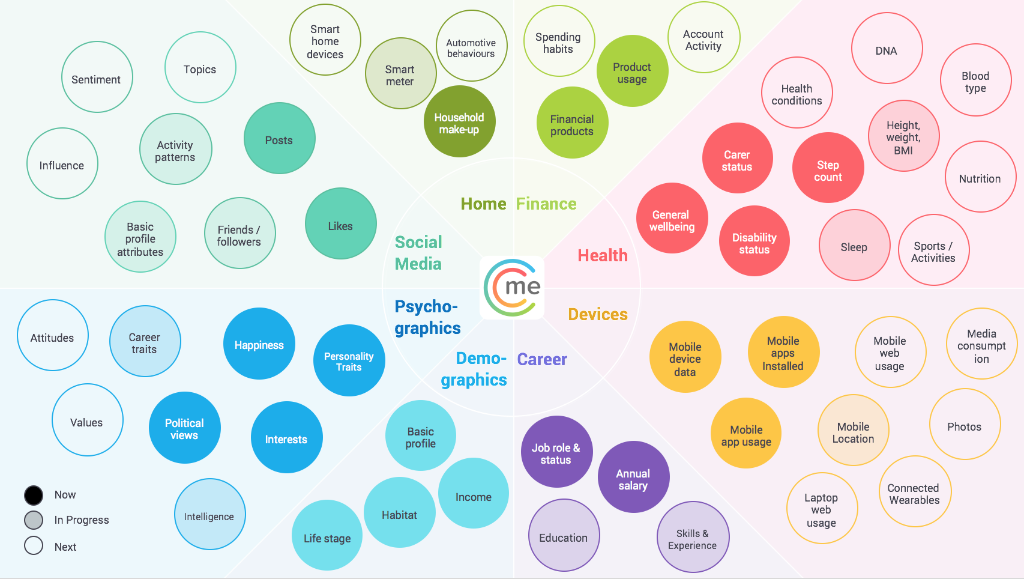

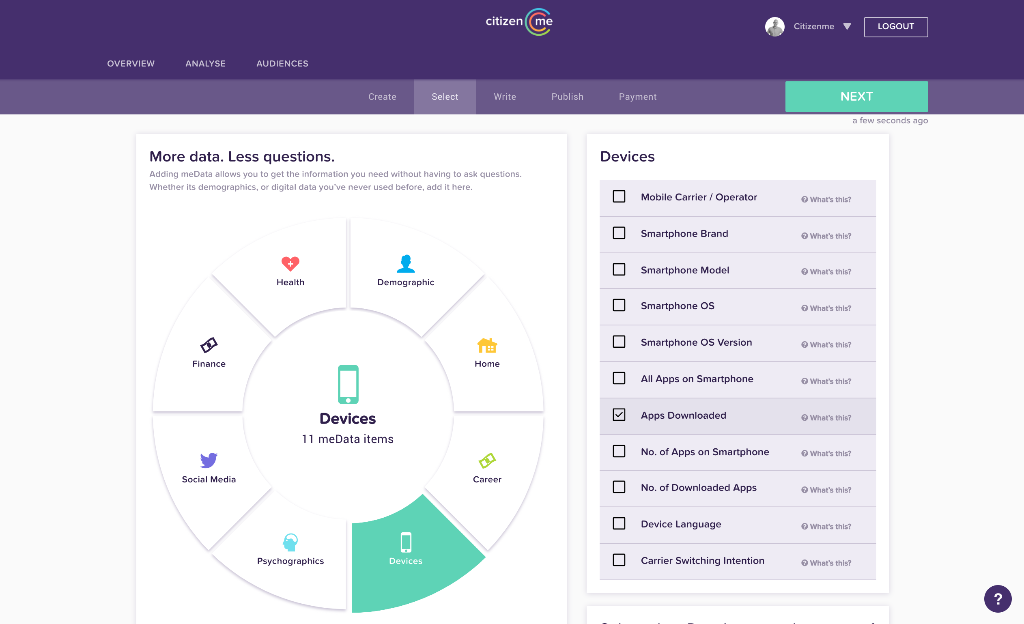

Part of the reason surveys can be so long for participants is they constantly have to answer the same questions over and over again. To prevent this we allow our users to store their answers as data items, so they can quickly ‘exchange’ them with businesses as part of the study.

It’s not just demographics users can store in their profile, we also help them collect their digital data. Things like social media activity and all the juicy usage data from the smartphone. This means participants spend less time answering questions, and businesses less time writing them.

3) Reward fairly

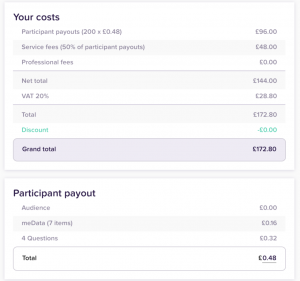

In the GRIT report, only 9% suppliers said ensuring a fair reward for participants was a key concern when designing a project. But if we want to encourage people to keep participating in research, we need to make sure they’re rewarded fairly for their time. One of the difficulties when buying research is often you have no idea how much the participant is actually receiving. So to address this, we are completely transparent about how much each participant gets paid (and how much we get paid too!). We calculate exactly how much goes to each respondent for participating (they get paid 8p per question, 4p per data item & 20p per premium data item they exchange), multiply this by the number of people you want to speak to, and then take a 50% transaction fee on top. Simples.

Cash is the number one way people want to be rewarded for research, so we pay participants directly into their PayPal account, with no minimum balance needing to be accrued. By approaching research as an exchange of data, where we are simply the facilitators, we are able to greatly increase the reward for the participant, whilst reducing the cost of research for businesses too.

4) Make it mobile

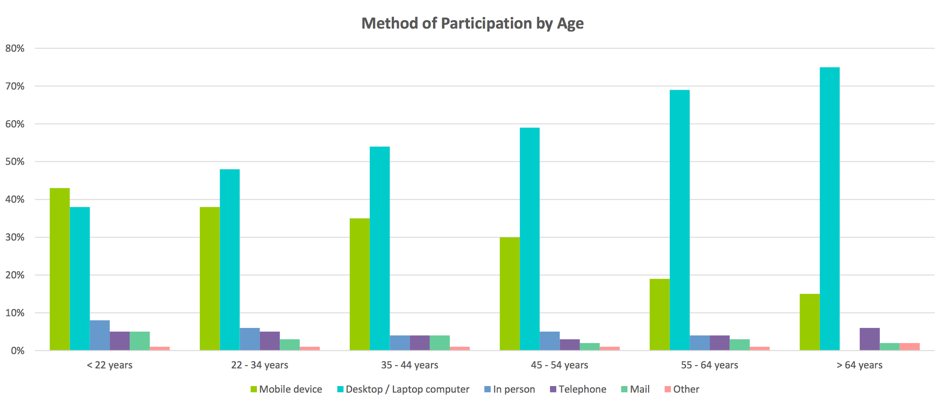

Mobile is fast becoming the go to device for research, especially for younger generations, as mobile penetration continues to grow around the world.

Allowing participants to complete research on their mobile device gives them more control of when and where they take a survey, in an environment that suits them. If the respondent is in control, they are less likely to speed through, or be distracted when completing the survey.

This flexibility also extends to the type of research – as we constantly have our devices on, mobile research allows for in the moment feedback, meaning responses are an accurate reflection of instinctive reaction. As discussed in one of our previous blogs, failing to optimise your survey for mobile has massive ramifications on data quality.

By encouraging respondents to participate in research on their mobile device, whole new realms of data possibilities are opened up too. Users of the CitizenMe app can collect large amounts of passive data about themselves that brands can get access to. Instead of asking what phone model someone has or what their mobile carrier is, a scan of the phone can give a 100% accurate view. Equally no one in their right mind would ask someone to write down every app they have installed on their phone, or every Page they like on Facebook, but these are data businesses can request from participants using CitizenMe.

Our users can (in theory) exchange data from any app they have on their smartphone… ones that have an open API anyway. We very much believe this is where the future of research is going – more data, less questions.

5) Decentralise data

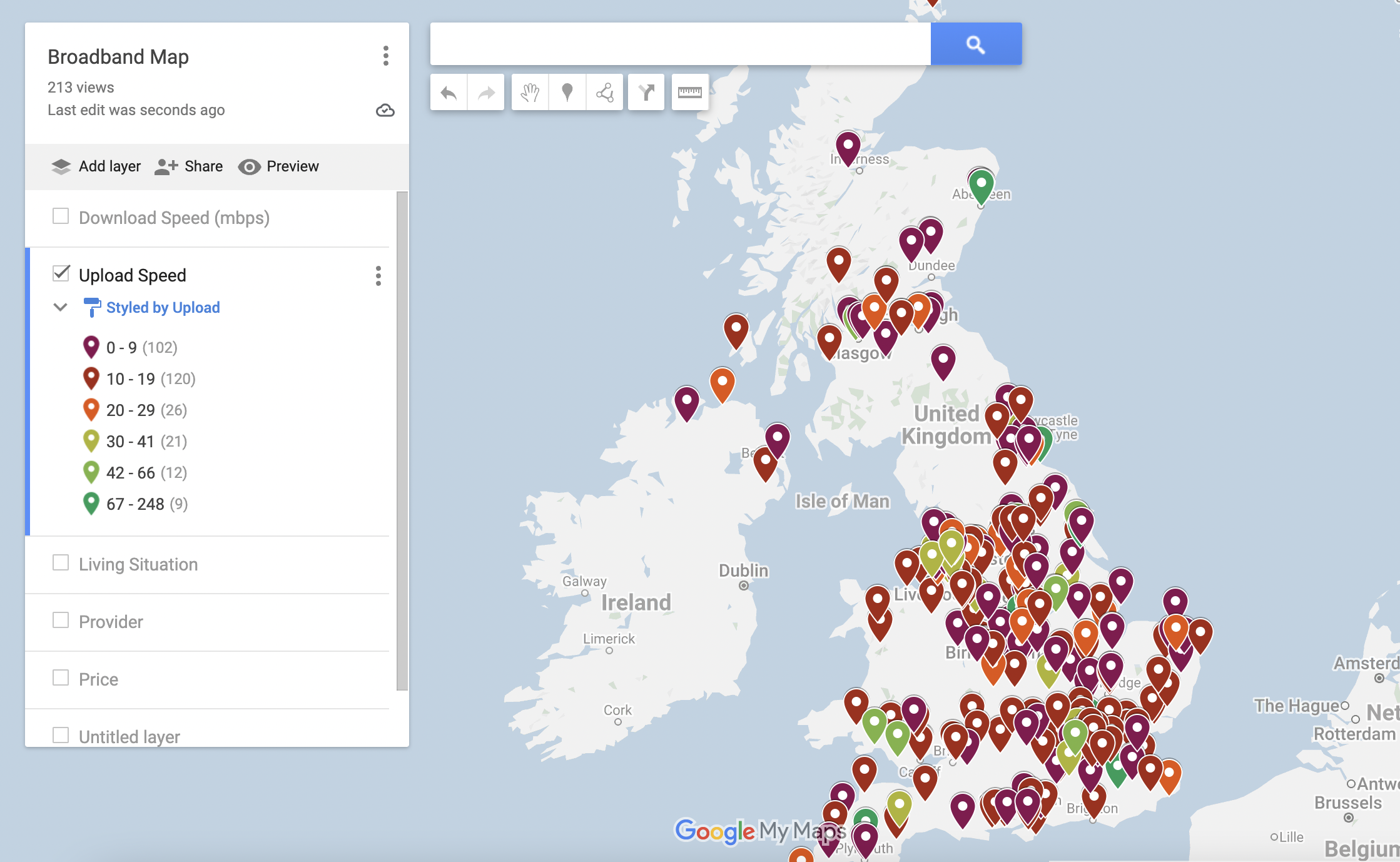

We see the future of research combining more and more data types, and with GDPR coming into play next year, research agencies have a responsibility to ensure their customers’ data is secure now more than ever. If we want users to continue to exchange highly personal information (data that is potentially personally identifiable) they need to know it is completely safe. The more data we collect about individuals and store in a centralised place, the more dangerous data breaches become.

To overcome this, CitizenMe doesn’t store any data about respondents. All data that a user pulls into the app is stored on their smartphone, and backed up to a personal cloud of their choice with encryption. They are the gatekeepers for every exchange they have with brands, and when they authorise an exchange of any data for research purposes, the data leaves the device in an anonymised format.

We see this is the only way to ensure people’s data is safe. By giving them back control of it. When this happens, people know they are exchanging data on their terms, and ensures they are far more willing to participate.

- Posted In:

- Business blog

Leave a Reply